Mortgage in Spain

Mortgage Broker

ABOUT US

At Mortgage in Spain.es, our mission is to help international clients buy a home in Spain through responsible, tailor-made mortgage solutions.

We have a 99% mortgage approval rate for our clients, thanks to our expertise, personalized service, and strong relationships with leading Spanish banks

We are specialists in mortgages for non-residents, with over 15 years of experience

We work only with top-tier banks and offer our services with 0% broker fees – our work is paid by the bank that grants your mortgage.

🔹 Licensed by the Bank of Spain

🔹 Certified multilingual team – English, French, Dutch & Spanish

🔹 Fully online process – clear, fast and secure

🔹 Nationwide coverage – including the Balearic & Canary Islands

Experts in international clients from over 20 countries across Europe and beyond

We provide expert support to

non-resident clients from:

🇬🇧 UK · 🇮🇪 Ireland · 🇫🇷 France · 🇧🇪 Belgium · 🇳🇱 Netherlands · 🇨🇭 Switzerland · 🇩🇪 Germany · 🇵🇱 Poland · 🇺🇸 USA · 🇨🇦 Canada · 🇲🇽 Mexico · 🇸🇦 Saudi Arabia · 🇦🇪 Dubai · 🇷🇴 Romania · 🇸🇪 Sweden · 🇳🇴 Norway · 🇩🇰 Denmark · 🇮🇹 Italy · 🇨🇿 Czech Republic · 🇱🇹 Lithuania · 🇪🇪 Estonia · 🇫🇮 Finland

We understand the financial documentation of each country and know exactly how to structure your mortgage file for a successful outcome with Spanish lenders.

We find the best mortgage offer for your personal situation

We carefully analyze your profile, compare offers from several banks, and negotiate the best mortgage conditions – whether fixed, variable or mixed rate – based on your needs and goals. We guide you through every step, from the initial assessment to final signature at the notary, with full transparency.

With us, you’ll know exactly:

- How much you can borrow from a Spanish bank

- What deposit you need

- The exact costs and taxes involved

- What documents to provide (and how to present them properly)

- And how to complete the entire process 100% online

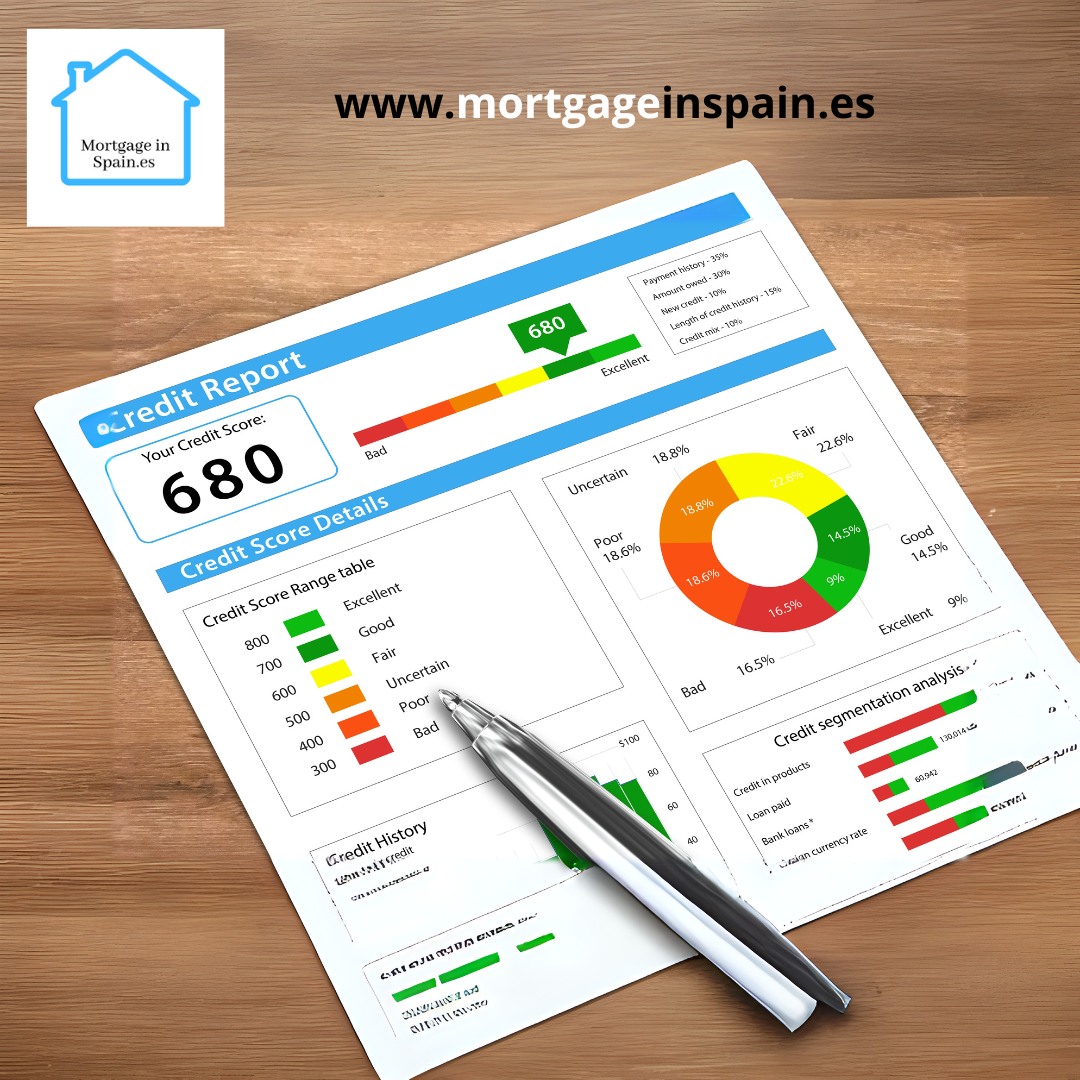

Your credit report is not affected until you sign the official offer at the notary.

360º premium service through our trusted partners:

- NIE application (optional, fast & remote)

- Independent real estate lawyers

- Currency exchange specialists

- Reputable real estate agencies

- Setup of water, electricity, internet and alarm systems after purchase

With Mortgage in Spain, getting a mortgage is easy, secure and stress-free.

Let us find the best mortgage for you and simplify your property purchase in Spain.

The best way to get your Mortgage in Spain

Save time and money

We handle the entire mortgage process for you, eliminating the need to visit multiple banks to secure the best deal. We partner with some of the best banks in Spain, specializing in mortgages for non-residents, to find the best offer tailored to your specific circumstances.

Professional support

Mortgage in Spain is run by certified banking professionals with experience from Spanish Banks. We specialise on non resident mortgages.

You will not pay anything for our services. Our more than 15 years of experience make our banking agreements successful.

As a mortgage broker operating in Spain, we understand that purchasing a property in a foreign country can be a daunting and complex process. Spain is a popular destination for non-residents seeking to invest in property, whether it's for personal use or as a rental income investment. As such, we are dedicated to providing non-residents with all the necessary information to help make informed decisions about their mortgage options in Spain.

Firstly, it's important to understand that non-residents can obtain mortgages in Spain, just like residents can. However, the process and requirements may differ slightly. The amount of mortgage available to non-residents is usually lower than that available to residents, and the interest rates may also be higher. This is because lenders perceive non-residents as higher risk borrowers, as they do not have a permanent presence in Spain.

The mortgage application process for non-residents is straight forward. However, there are certain requirements that must be met. Non-residents will need to provide proof of income, such as payslips or bank statements, and may need to provide additional documentation such as a tax identification number. Lenders will also require proof of employment and the source of income.

When it comes to the types of mortgages available to non-residents in Spain, there are several options. Fixed-rate mortgages are popular, as they provide certainty and stability in monthly payments. Variable-rate mortgages are also available, but they can be more volatile as they are linked to the Euribor rate.

Finally, it's important to work with a mortgage broker who is familiar with the Spanish mortgage market and can guide you through the process. At our brokerage, we have experienced professionals who can provide personalized advice and help you find the best mortgage for your needs.

In summary, non-residents can obtain mortgages in Spain, but the process and requirements may differ slightly from those for residents. It's important to work with a broker who can guide you through the process and help you find the best mortgage for your needs.

Mortgage in Spain

Enjoy your new home in Spain