How to get a mortgage in Spain in 2025

Everything you need to know in 2025 to get a mortgage in Spain as a non-resident requirements, documents, costs, and expert support every step of the way.

Thinking of buying a property in Spain in 2025?

If you're considering buying a second home or investment property in Spain, understanding how to get a mortgage as a non-resident is essential. Spain continues to be one of the most attractive destinations in Europe for foreign buyers, thanks to its lifestyle, climate, and relatively low property prices compared to other EU countries.

In this guide, we explain everything you need to know about how to get a mortgage in Spain in 2025, including the latest rules, documents required, and how a licensed mortgage broker can help you save time and money.

1. Can foreigners get a mortgage in Spain in 2025?

✅ Yes — and it’s easier than you think!

Spanish banks continue to offer mortgages to non-resident buyers from a wide range of countries, including 🇬🇧 the UK, 🇺🇸 the USA, 🇦🇪 the UAE, 🇸🇦 Saudi Arabia, 🇮🇪 Ireland, 🇫🇷 France, 🇧🇪 Belgium, 🇳🇱 the Netherlands, 🇩🇪 Germany, 🇲🇽 Mexico, and many more. However, the mortgage conditions may vary depending on your nationality and country of tax residence.

Here are the key aspects to keep in mind:

- Maximum financing: Generally up to 70% of the purchase price for non-residents. However, this percentage may be lower depending on the bank’s policy for your nationality and financial profile.

- Loan term: Up to 25 years for non-residents.

- Interest rates: Fixed rates in 2025 can range from as low as 2.20% to 3.5%, depending on your profile, income structure, and the bank's offer.

- Debt-to-income ratio: Your monthly financial obligations (including your new Spanish mortgage) must usually not exceed 35% of your net monthly income.

💡 Important: The way Spanish banks calculate the debt ratio may differ from what you're used to in your home country. For example, if you already have interest-only mortgages, or you earn rental income, these are often treated differently in Spain. That’s why working with a mortgage broker specialized in non-residents like us is essential to present your financial profile correctly and avoid rejection or delays.

2. Steps to get a mortgage in Spain as a non-resident

Here’s a clear and proven step-by-step process:

Step 1: Fill in our pre-qualification form

The first step is to complete our secure online pre-qualification form, where you’ll be asked to provide key financial details:

- Country of residence and nationality

- Monthly income and employment status

- Savings available for the down payment

- Property budget or purchase price

- Existing financial obligations

This allows us to evaluate your situation in advance and assign the right mortgage advisor to your case. Once reviewed, we’ll contact you to schedule a personalised call, so you receive advice tailored to your specific profile from the very beginning.

🧠 This step ensures a smooth, time-saving and successful process.

Step 2: Personal pre-evaluation by a licensed broker

At Mortgage in Spain, we perform a full pre-assessment using the same methods that Spanish banks apply. This includes:

- Calculating your debt-to-income ratio

- Estimating the maximum mortgage you could qualify for

- Advising you on any potential adjustments before applying

💡 We are a mortgage broker licensed by the Bank of Spain.

🎯 We specialise in helping non-residents get mortgages in Spain, no matter where you live or how complex your income structure may be.

Step 3: Submit your documents

Once the initial evaluation is complete, we will guide you through the documentation phase. The specific documentsrequired will depend on your country of residence, type of employment (employee, self-employed, company owner, etc.), and the origin of your savings.

As a general guideline, the following documents are often requested:

- Payslips and employment contract

- Income tax returns (last 2 years)

- Bank statements (6 months) of the account(s) holding your deposit

- Proof of savings origin (e.g. salary savings, property sale, inheritance)

We will explain everything clearly and in your language, and help you prepare each document to match Spanish bank standards.

Step 4: Matching with the right bank

We present your case only to the top Spanish banks that offer mortgages to non-residents, based on your nationality, income structure, and property type. This ensures that:

- You receive an offer that matches your real situation

- You avoid delays or rejections due to presenting your profile to the wrong bank

Once your file is reviewed, you’ll receive a binding mortgage offer (FEIN) to evaluate and accept.

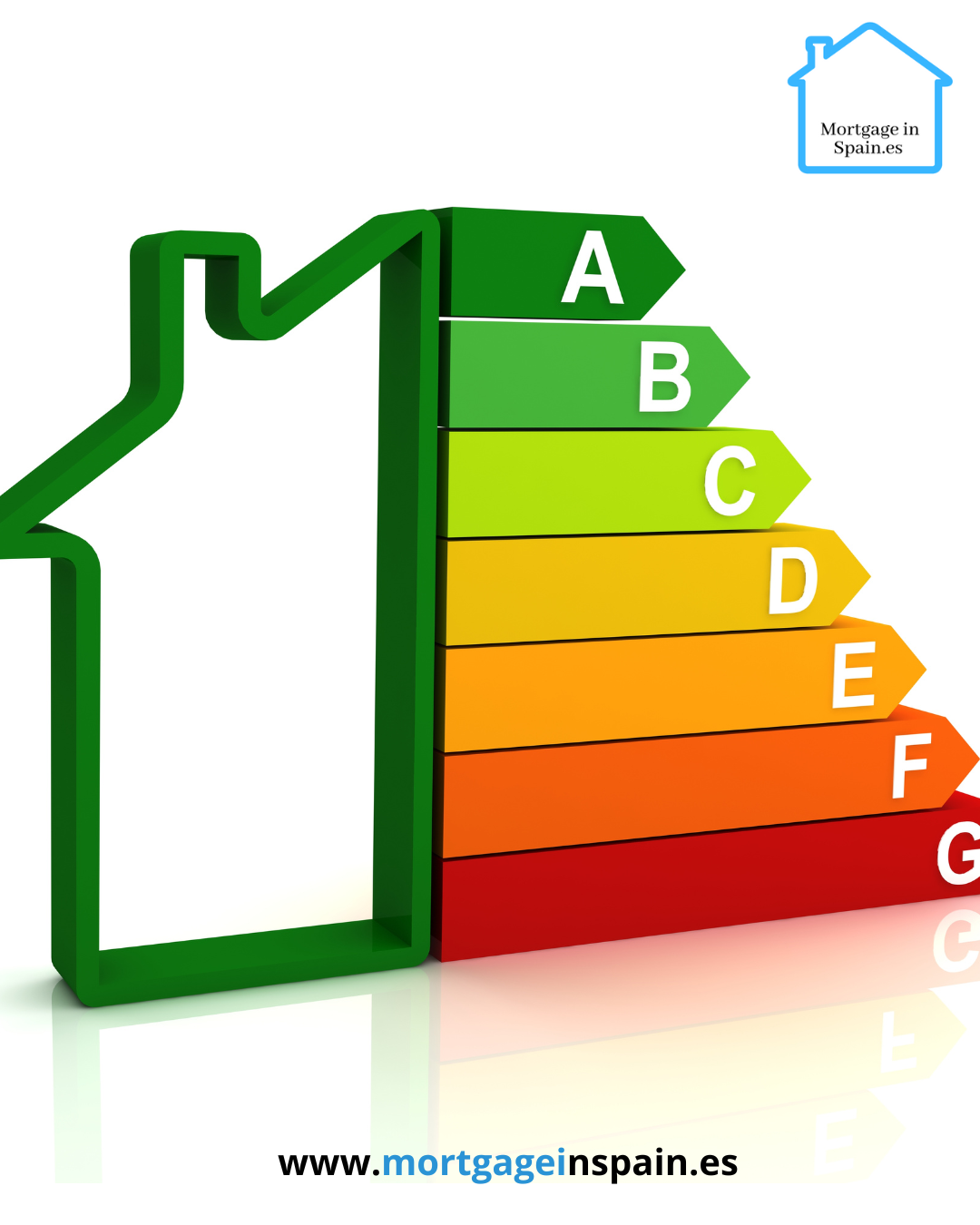

Step 5: Property valuation (Tasación)

Before the bank gives final approval, a property valuation report is required. We’ll help you arrange this through the best appraisal company operating in your property’s area, ensuring the report is valid and professional.

📌 This valuation is valid for all banks and remains usable for several months — no need to repeat the process.

💰 How much does it cost?

- The cost typically starts at €300 for smaller properties.

- For average homes, you can expect to pay between €250 and €600, depending on the property’s value.

- In cities like Madrid or Barcelona, prices can go up to €550 or more.

📊 How is it calculated?

Valuation fees follow a sliding scale based on:

- Final value of the property

- Type and size of the property

- Location and complexity of the report

🧾 Who pays for it?

The buyer covers the cost of the valuation. Although some banks may offer promotions covering this fee, we recommend choosing your own trusted valuation company to ensure full independence.

Step 6: Final approval and signing

Once the bank has received the valuation and reviewed all your documents, they issue the final offer. From there, we coordinate the following:

- Acta de Transparencia (Transparency appointment with notary)

- Legal explanations and translations if needed

- Preparation of the signing appointment at the notary

- Support until you have the keys to your new home in Spain

3. Costs involved when getting a mortgage in Spain

You should prepare for the following costs:

ConceptApproximate CostDown payment (30%)From €90,000 (on a €300,000 property)Taxes & notary fees10–13% of the purchase priceProperty valuation (tasación)€300–€600 (based on value of property)Lawyer (recommended)1% of the price

Our mortgage broker service is free for the client — our fees are paid by the bank upon completion.

4. Why choose Mortgage in Spain Mortgage Broker?

Working with us means peace of mind and faster approval, especially if you’re buying from abroad.

Here’s why clients from 🇬🇧 UK · 🇺🇸 USA · 🇦🇪 Dubai · 🇫🇷 France · 🇧🇪 Belgium · 🇳🇱 Netherlands · 🇨🇭 Switzerland · 🇩🇪 Germany · 🇲🇽 Mexico · 🇸🇦 Saudi Arabia · 🇮🇪 Ireland and more choose us:

- ✅ 99% mortgage approval rate

- 🏛 Licensed by the Bank of Spain

- 📄 We simplify and explain all documents in English

- 🧾 We understand tax documents from your country

- 📲 100% online process — no need to travel

- 🧑⚖️ We connect you with trusted lawyers and real estate agents

- 💶 Our service is completely free for the client

5. Our 360º service: from pre-approval to notary

We don’t just get your mortgage — we take care of the entire buying journey:

- ✅ Initial mortgage evaluation and feasibility

- ✅ Tax and cost calculation

- ✅ NIE management online

- ✅ Secure reservation and valuation coordination

- ✅ Mortgage negotiation with the right bank

- ✅ Arras contract coordination (purchase deposit)

- ✅ Notary appointments and legal guidance

- ✅ Full support until the final signature and handover

Ready to get your mortgage in Spain?

Start now with a free evaluation — you’ll know how much you can borrow and what options are available for your specific profile.

📩 Contact us today or complete the online form to begin your journey to owning a property in Spain in 2025.

🇪🇸 Buying a Home in Spain as a Non-Resident? Here’s the Solution! 🏡

✅ We Make It Easy – Your Mortgage, Simplified!

Mortgage in Spain, Mortgage Broker specializes in helping non-residents secure the best mortgage deals hassle-free.

✔ Fast-track approval – Preliminary agreement in 48 hours

✔ Expert negotiation – We work with top Spanish banks to get you the best interest rates

✔ No brokerage fees – Our service is 100% free for you (the bank pays our commission)

✔ Personalized service in English, French, Dutch, and Spanish

✔ Full assistance from start to finish – We handle the paperwork and connect you with lawyers, real estate agents, and currency exchange services

Experts in international clients from over 20 countries across Europe and beyond

We provide expert support to non-resident clients from:

🇬🇧 UK · 🇮🇪 Ireland · 🇫🇷 France · 🇧🇪 Belgium · 🇳🇱 Netherlands · 🇨🇭 Switzerland · 🇩🇪 Germany · 🇵🇱 Poland · 🇺🇸 USA · 🇨🇦 Canada · 🇲🇽 Mexico · 🇸🇦 Saudi Arabia · 🇦🇪 Dubai · 🇷🇴 Romania · 🇸🇪 Sweden · 🇳🇴 Norway · 🇩🇰 Denmark · 🇮🇹 Italy · 🇨🇿 Czech Republic · 🇱🇹 Lithuania · 🇪🇪 Estonia · 🇫🇮 Finland

99% mortgage approval rate. Let us help you secure your Spanish mortgage—stress-free and with no upfront cost.

Avoid stress and delays! Leave your contact details now and let our experts guide you step by step toward your dream home in Spain!

🏡 Your Spanish property is within reach – Let’s make it happen today!

Send a message